Did You Incur Any Tuition or Continuing Education Expenses

Education and study – specific self-education expenses

Claim a deduction for specific self-education or study expenses, if it is relevant to earning your income.

On this page

- Eligibility to claim

- Specific expenses you can claim

- Specific expenses you can't claim

- Calculating your claim

- Working while you study

Eligibility to claim

You may be able to claim a deduction for specific expenses related to your self-education or study, if the education has a sufficient connection to earning your employment income.

If the self-education or study is too general in terms of your current work, the connection between the education expenses and your income-earning activities does not exist.

If you work while you study and incur self-education expenses, you can claim a deduction. You may also be eligible if you receive a taxable scholarship.

If you work and study at the same time, the study relates to your current employment and you can satisfy any of these conditions, you can claim a deduction.

- You're upgrading your qualifications for your current employment – for example, upgrading from a Bachelor qualification to a Masters qualification.

- You're improving specific skills or knowledge you use in your current employment – for example, a course that will allow you to operate more machinery at work.

- You're a trainee employee and the course you are undertaking forms part of that traineeship – for example, an apprentice hairdresser doing a certificate III in hairdressing which is a compulsory component of their apprenticeship.

- You can show that at the time you were working and studying, your course led, or was likely to lead, to an increase in employment income – for example, a teacher who will automatically get a pay increase as a result of completing the course.

Example: work-related self-education expenses

Louis is a computer science student who works at the university laboratory installing computers. The course and the job are generally related, and what Louis learns might help him in his job.

However, the high-level professional skills Louis acquires are well beyond the skills he requires for his current job and employment. Consequently, there is not sufficient connection between his job and his course, and he can't claim a deduction for work-related self-education expenses.

End of example

Use the self-education expenses calculator to help you work out if you are eligible to claim a tax deduction for work-related self-education expenses.

Taxable scholarship recipients

You can claim a deduction for self-education expenses if, in doing the course, you are satisfying study requirements to maintain your right to the scholarship.

Government assistance and benefit recipients

You can't claim a deduction for self-education expenses if you only receive a taxable government assistance payment or benefit that is eligible for a beneficiary tax offset. Examples of these benefits are Austudy, ABSTUDY and Youth Allowances.

Use the is my scholarship taxable? tool to help you work out if your non-government scholarship is taxable.

Specific expenses you can claim

If you meet one of the eligibility requirements above, you can claim a deduction for the following self-education expenses:

- tuition fees, including fees payable under FEE-HELP, VET Student Loan (formerly known as VET FEE-HELP) (but doesn't include expenses paid under HECS-HELP)

- self-education expenses you pay with your OS-HELP loan

- textbooks, professional and trade journals

- stationery

- photocopying

- computer expenses

- student union fees

- student services and amenities fees

- accommodation and meals – when the course requires you to travel and be away from home for one or more nights

- additional running expenses if you have a room set aside for self-education purposes – such as the cost of heating, cooling and lighting that room while you are studying in it

- allowable travel expenses.

You can claim a deduction for the amount (percentage) you use your computer for self-education purposes. That is, part of expenses for the:

- interest on money you borrow to finance the cost of a computer

- cost of repairing a computer

- decline in value (depreciation) of the cost of your computer.

Work out your use for self-education purposes

If you use your computer for both self-education and private purposes, you will need to work out the amount (percentage) of use for self-education.

For example, if you use your computer 40% of the time for self-education purposes and 60% for private purposes, you can only claim 40% of the total expenses relating to the computer.

A computer upgrade is not a repair. You may claim the cost of an upgrade to an existing computer as part of the decline in value (depreciation) of the computer.

Interest on borrowings

You can claim the interest on a loan where you use the funds to pay for deductible self-education expenses.

Example: interest on borrowings

Tim is a solicitor undertaking a Master of Law degree part-time. He borrows $10,000, repayable over three years, to pay for his tuition fees. He incurs $1,000 interest each year.

Tim can claim a deduction for interest in each of the three years.

End of example

Decline in value (depreciation)

A depreciating asset is an asset that has a limited effective life and can reasonably be expected to decline in value over time.

You can claim decline in value expenses for items you use for self-education purposes. For example:

- computers

- professional libraries

- desks and chairs

- filing cabinets and bookshelves

- calculators

- technical instruments and tools

- other equipment (such as desk lamps).

Use the Depreciation and capital allowances tool to help you with calculating a deduction for a depreciating asset.

Accommodation and meals

The day-to-day costs you incur relating to your accommodation and meals are generally a private, non-claimable expense. You may claim the cost of accommodation and meals only when:

- you are participating in self-education activities

- your course requires you to be temporarily away from home for one or more nights.

Home study expenses

If you study at home, you may be able to claim a deduction for expenses relating to:

- decline in value of and repairs to your home office furniture and fittings

- additional running costs for heating, cooling and lighting

- cleaning expenses representing the period you use the room for self-education activities.

Alternatively, you can use the fixed rate method per hour of usage.

Travel expenses

For work-related self-education, you can claim the cost of travel where the course requires you to be temporarily away from your home for one or more nights.

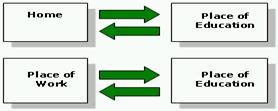

You can also claim the cost of daily travel from your:

- home to your place of education and back

- work to your place of education and back.

If you receive a taxable scholarship and you are not employed by the scholarship provider, you can only claim the cost of travel where there is a course requirement for you to attend activities at locations other than your normal place of education.

Travel you can't claim

For work-related self-education, you can't claim the cost of the last stage of your travel from:

- home to your place of education, and then to work

- work to your place of education, and then to your home.

However, the expense you incur for the last stage of travel, from your place of education and then to your workplace, or place of education and then to your home, may be used as a Category E expense (see Calculating your claim).

If you receive a taxable scholarship and are not employed by the scholarship provider, you can't claim the cost of travel from your home to your normal place of education and back. However, these expenses may be used as a Category E expense (see Calculating your claim).

If you use public transport, you should keep a record of the fares you pay to travel to and from the locations listed.

If you use a car, you can use one of two methods to calculate your travel expenses.

Use the work-related car expenses calculator to help you work out your deduction.

Specific expenses you can't claim

You can't claim a tax deduction for the following expenses:

- tuition fees to an education provider you pay or the Australian Government pays under HECS-HELP

- the cost of accommodation and meals associated with day-to-day living expenses

- repayments you make (whether compulsory or voluntary) on debts you may have under the following loan schemes

- HECS-HELP

- FEE-HELP

- OS-HELP

- VET Student Loan (formerly known as VET FEE-HELP)

- SA-HELP

- SFSS

- Trade Support Loans program (TSL)

- Student Start-up Loan (SSL)

- ABSTUDY Student Start-up Loan (ABSTUDY SSL).

Calculating your claim

Using the self-education expenses calculator will give you an estimate of the deduction you may claim for self-education expenses in your tax return.

Alternatively, the following procedures will help you understand how the estimate of your claim is calculated.

The following table shows five categories of expenses and the types of self-education expenses to include in each:

| Category | Allowable expenses |

|---|---|

| A | Tuition fees, textbooks, stationery, student union fees, student services and amenities fees, public transport fares, car expenses worked out using the 'logbook' method (other than the decline in value of a car), running expenses for a room set aside specifically for study. |

| B | Decline in value (depreciation) deductions such as a computer, desk, or car for which you are claiming a deduction in Category A under the 'logbook' method. |

| C | Repair costs to assets used for self-education purposes. Don't include car repair expenses here as it is part of car expenses in Category A or D. |

| D | Car expenses using the 'cents per kilometre' method – you can't use this method if you have used the 'logbook' method in category A. |

| E | Expenses you have incurred but can't use as a deduction – for example:

These expenses can be used to offset the $250 reduction to your Category A expenses |

$250 reduction

In certain circumstances, you may have to reduce your allowable self-education expenses by $250.

If the total of your expenses consists solely of Category A items, your total must be reduced by $250.

Example: category A expenses

Maureen is an apprentice hairdresser studying hairdressing at a TAFE college. Her course fees, textbooks and public transport fares are all Category A expenses totalling $290. Maureen can only claim $40 after the $250 reduction.

End of example

You may have other expenses - some of which are not allowable as a deduction (see Category E) that can be offset against the $250 before you have to reduce the amount you can claim.

The formula for calculating your claim for work-related self-education expenses is:

Total claim estimate = A − [$250 − (C+D+E expenses)]+B+C+D

If the total of (C+D+E expenses) is greater than $250 it is reduced to 0, not a negative amount.

To calculate an estimate of your claim, complete the steps in the following table.

| Step | Action |

|---|---|

| 1 | Add together the expenses you incurred for Category A expenses. |

| 2 | Add together the totals for your Category C, D and E expenses. |

| 3 | Subtract the Step 2 total from $250. If this is a negative amount, show '0'. |

| 4 | Take the Step 3 amount away from the Step 1 amount. If this is a negative amount, show '0'. |

| 5 | Add the Step 4 amount to Categories B, C and D expenses. This amount is the estimate of your self-education claim. |

When calculating travel expenses for a car, you can only use one calculation method. If you choose to include car expenses in Category A using the 'logbook' method, you can't calculate an amount for Category D using the 'cents per kilometre' method.

A car's repair expenses should be included as part of car expenses in Category A or D. Do not include a car's repair expenses in Category C.

If you are claiming car expenses at more than one question (for example, at D4 'Work-related self-education expenses' and D1 'Work-related car expenses') then you will need to allocate the applicable expenses between the questions.

Use the self-education expenses calculator to help you work out your deduction.

For more information, see TR 98/9 Income tax: deductibility of self-education expenses incurred by an employee or a person in business

Working while you study

Tax-free threshold

If you are an Australian resident, you don't pay tax on the first $18,200 of your income (this is called the 'tax-free threshold').

If you receive a taxable allowance such as Youth Allowance or Austudy, the tax you pay on this allowance normally takes the tax-free threshold into account. If you are also employed, you shouldn't claim the tax-free threshold from your employer or other payer. If you do, you are likely to have to pay a tax bill at the end of the financial year. However, if you are certain that your total income for the year from all sources will be less than $18,200 you can claim the tax-free threshold from each of your payers.

A part-year tax-free threshold applies if you became, or ceased to be, an Australian resident.

Study and training support loans

The Australian Government provides loans to students studying higher education, trade apprenticeships and other training programs. These loans help them pay their higher education fees and to study overseas.

If you are working while studying, you may need to make repayments to these loans. Compulsory repayments are made through the tax system. You may also make voluntary repayments to reduce your balance faster.

Being your own employer

Many students earn additional income by running small businesses, such as selling craftware, mowing lawns or building websites. You must include business income (like income from employment) in your annual tax return.

Claim a deduction for specific self-education or study expenses, if it is relevant to earning your income.

Source: https://www.ato.gov.au/Individuals/Income-and-deductions/In-detail/Education-and-study/

0 Response to "Did You Incur Any Tuition or Continuing Education Expenses"

Post a Comment